How Billionaires Will Steal Our Country's Wealth

Why running our government like a business will lead to economic collapse

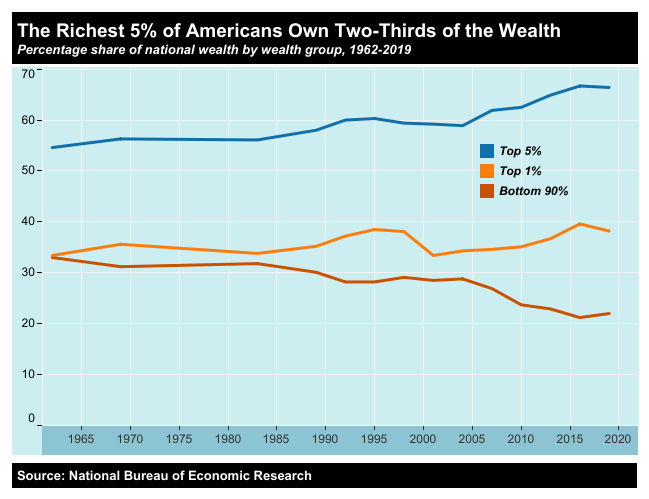

Starting in 1980 the percentage of wealth held by US households began to diverge, with the super rich gaining more wealth at the expense of the bottom 90% of the population. This wouldn’t be surprising to most economists. In fact it’s well established that wealth will inevitably become concentrated.1 And this would be true even if there were no inequality of ability or opportunity.2 In other words, without intervention, the rich will continue to get richer.

What is unusual is the relatively stable period prior to the 1980’s. So what changed?

In 1980 Ronald Reagan was elected president on the promise to reinvigorate the US economy via tax cuts for the wealthy, a policy he labeled “supply side economics”. (At the time the highest marginal income tax rate was 70%.) The claim was that lower taxes would free the wealthy to invest and cause a growing economy which would “trickle down” benefits to all. The policy was a failure, causing inflation, a federal deficit, and the beginning of the increase in wealth disparity that has continued to this day.

So why did Reagan’s tax cuts cause this trend? To understand that you need to understand how money moves through the economy and how it affects wealth distribution.

The Asset Economy

Many people think of wealth as money. But wealth is made up of assets.3 And although money is an asset, it is not a particularly valuable one. Why? Money has a relatively low rate of return, typically just slightly above the rate of inflation if invested, and negative if held as cash. But other types of assets can generate significant (passive) income.4 Desirable assets (and related income) include land (food or natural resources), real estate (rents), businesses (equities), and mortgages (bonds). For instance, a 5% return on a $2M asset would yield a passive income of $100,000 a year, well above the median income of US households.

But the average household earns their money in the form of wages and spends the majority of what they receive on expenses like food and shelter. For the poorest, who live paycheck to paycheck, there is little to no opportunity to save or invest. Those in the middle class may be able to save and invest a small portion of their income, for example in a house and/or 401K. But their house is usually shelter and not a particularly valuable or liquid investment5 and a 401K typically generates a fairly small percentage of their income requirements and isn’t readily accessible.

“Anyone who has ever struggled with poverty knows how extremely expensive it is to be poor.” James Baldwin

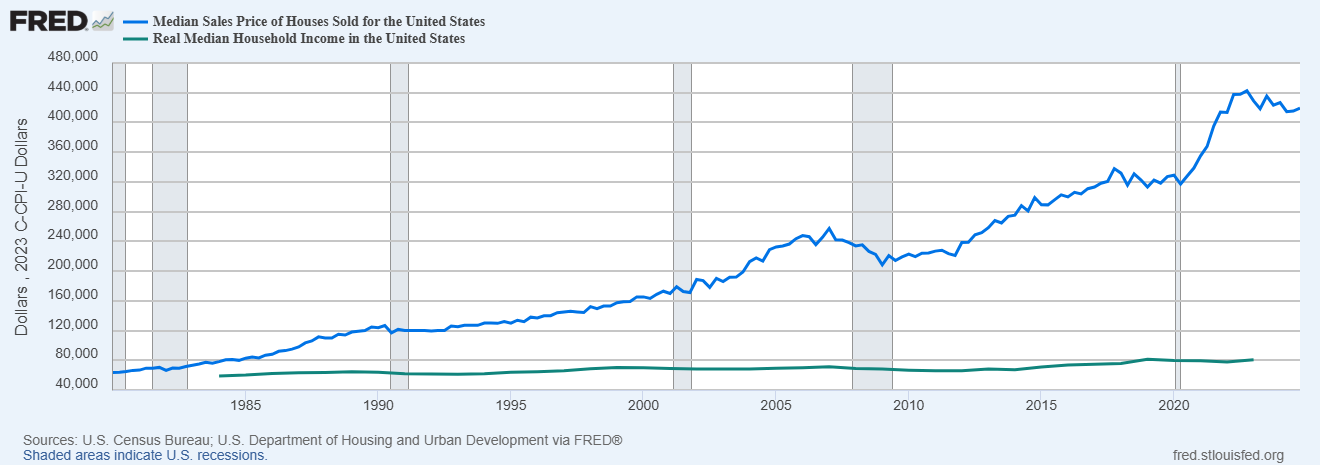

On the other hand, the wealthiest citizens living expenses are easily met via passive income which can then be used to buy more assets. As wealth gets increasingly concentrated the wealthy have to compete among themselves to buy these assets causing asset prices go up and making it even more difficult for lower income households to purchase them. For instance, the graph below shows the increase of US home prices compared to median household income.

A dramatic demonstration of this cycle is found starting with the huge injections of money into the economy during the covid crisis. When the government used deficit spending to help struggling families and businesses the money ultimately flowed to wealthy asset holders, causing an explosion in their wealth as shown in the chart below. In response home prices and the stock market soared.

Trumpenomics

Trumpublicans (and conservatives historically) claim that our economy is at risk of collapse due to debt and deficits caused by excessive government spending riddled by waste, fraud and abuse6. But the persistent budget deficits and growth in wealth of the super-rich implies that there is plenty of money. The real problem is that government deficits flow to the wealthy whose taxes are too low to repatriate them.

The conservative remedy? Cut taxes for the wealthy in pursuit of the ever elusive ‘trickle down’ benefits, but also cut already approved government spending via haphazard vandalism7 including cuts to the IRS workforce that will further reduce tax receipts. How is it possible that one of the wealthiest countries in the world with objectively the strongest economy is simultaneously vandalizing our public services while cutting taxes?

The answer is two fold:

The government owns a lot of valuable assets including public lands, buildings, and what are essentially non-profit businesses that provide public services such as healthcare, social security, the park service, transportation (roads, bridges, etc), and defense.

A major role of government is consumer protection via regulations related to anti-trust, banking, and product safety.

So the problem isn’t that government is inherently wasteful or incompetent, but that it is competing for assets and business opportunities with the private sector while restricting their ability to cheat their customers. Trump and his billionaire supporters see an opportunity to acquire and privatize them. And privatizing non-profit government services would only increase the cost to the average citizen.

This is a perfect example of a common theme among conservatives, running government like a business. Specifically like a billionaire hedge fund which takes over a company, strips it of its assets and cash, and leaves a rotting corpse.

Government for the People

So what can we do? Government needs to tax the wealthy and return our country to an economic system where all citizens share in our national wealth. The first step is to retake control of our democracy. Step two is to tax the wealthy and return the taxpayer dollars that are being hoarded by the super rich to our government.

How do we do it? It won’t be easy, and it won’t be fast. It will require a new political focus on inequality and the working class with new leadership from young progressive politicians.

Ready to take action?

Attend your local protest this Saturday the 19th. More info here.

Call your Senators and Representative and ask them to take action! Find your congresspeople here.

Assets are the physical resources of an economy. Land, real estate, natural resources, debt, businesses.

The mortgage is a liability, interest payments, property taxes and maintenance are expenses, and if it’s sold there will still be a need for housing, either by renting or buying another house.

By all traditional metrics our economy is the strongest in the world and the US is one of the richest countries in the world as measured by per capita GDP.

See my previous post “Waste, Fraud, and Abuse”

Government is about people not $$$. Greed will choke them out.