Trumpublicans Trickle Up Economics

Why trickle-down doesn't

Ronald Reagan was elected in 1980 on a promise to re-invigorate the US economy using the theory of supply side economics. His plan was based on the idea that cutting taxes for the wealthy would result in more investment and a growing GDP that would offset the loss in tax revenue and ‘trickle down’ prosperity to workers.1

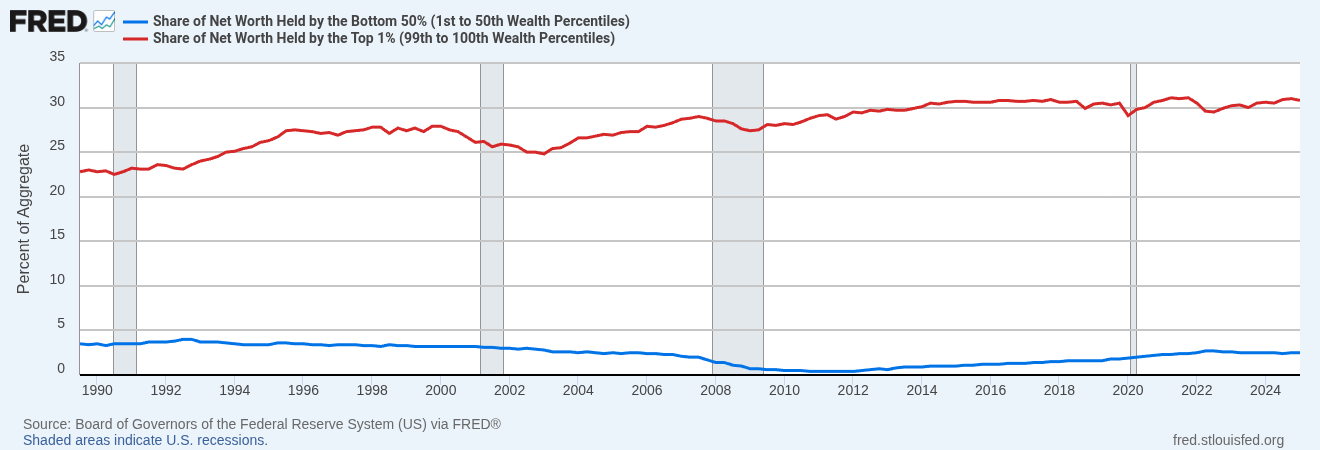

It didn’t work. Ever since then, with the exception of the Clinton administration, the federal government has been running consistent deficits resulting in a rising federal debt and more money left in the economy. (Federal deficits are the difference between what the federal government spent and what they collected in the form of taxes.) Where did all that money go? It trickled up. Today, the top 1% of households own 31% of the nations wealth while the lower 50% of households own about 2.5%.

How Money Trickles Up

When the government injects money into the economy it gets spent. Lower income families spend any money they have on payroll taxes, rent, food, car payments, and other expenses. There’s usually very little left for savings or investing.

Middle class families spend most of their money on expenses but may have enough surplus to save and invest. And although money is an asset, it isn’t a very good one since inflation shrinks its value. Stocks, bonds, houses, and businesses are assets that can build wealth through appreciation and passive income.

But the truly wealthy, say someone who earns $1M a year in passive income, spend a relatively small portion of their income on expenses. And their income doesn’t come from work. It comes from the assets that they own. So what do they do with more money? They buy more assets. This may explain why wealthy conservatives are willing to run federal deficits in spite of their claims that they oppose them.

This is a continuous process, where all the spending by the less wealthy creates additional income for asset holders, which allows them to buy more assets. And since assets are limited, the competition to buy assets causes their prices to rise. The result? A never ending increase in wealth at the top.

Tax Wealth, Not Work

The solution? The government needs to recapture the ‘extra’ money that trickles up to the wealthy by raising their taxes. Who’s wealthy? Not the lower 50% of US households with an average net worth of $60,000. But clearly the upper 1% who own 30% of our nations wealth and whose average net worth is $37M.

And the best way to do this is to tax wealth, not the wages of working people who are already burdened by payroll taxes to fund their retirement and health care plus regressive taxes on spending (sales taxes). A wealth tax only taxes those who can afford it.

If you’re interested in learning more about money vs. wealth, income inequality, and wealth taxes take a look at these resources…

Gary’s Economics, Gary Stevenson

Wealth and Poverty, Robert Reich

Capital in the 21st Century - Thomas Piketty

How do we get there?

Certainly changing tax policy to a system that would collect more from the wealthy will face fierce and well funded opposition. But if we don’t fix this problem the future for our economy is bleak. We have to fight. Here’s what you can do…

Educate yourself and others on the topics of wealth inequality, money versus assets, and how inequality is destroying our economy.

Vote for progressive candidates that will fight for workers.

Advocate for unions, raising the minimum wage, repealing Citizen’s United, limiting campaign contributions, banning stock purchases by congressional representatives. Get money out of politics.

Support bloggers, writers, politicians who are fighting for equality by subscribing to and sharing their work.

This will not be a quick or easy fight. But our future depends on winning it. Join the battle to Tax Wealth, Not Work!