Tax Wealth, Not Work

How Wealth Inequality is Stealing Our Future

Near the end of Trump’s latest campaign I was convinced that Kamala Harris would win. A big part of that was the old saying ‘it’s the economy stupid’, and by normal metrics the economy was strong. Strong enough that the October cover of the Economist Magazine declared the US economy “The Envy of the World”.

But Trump campaigned on Biden’s ‘disastrous economy’1 and made promises to lower prices, bring back auto manufacturing, and get gas prices to $2.2 And he won.

So is the economy good or bad? It turns out that it depends. Most economists and news headlines focus on metrics like inflation, the stock market, and employment. But these are broad averages. And although most economists, politicians, and TV personalities are experiencing a great economy a lot of US citizens aren’t.

One clue as to why may be found by comparing worker compensation with productivity, the amount of value that their labor produced. (graph below) It’s clear that something changed around 1970, when wages no longer increased at the same rate as the value to their employer.

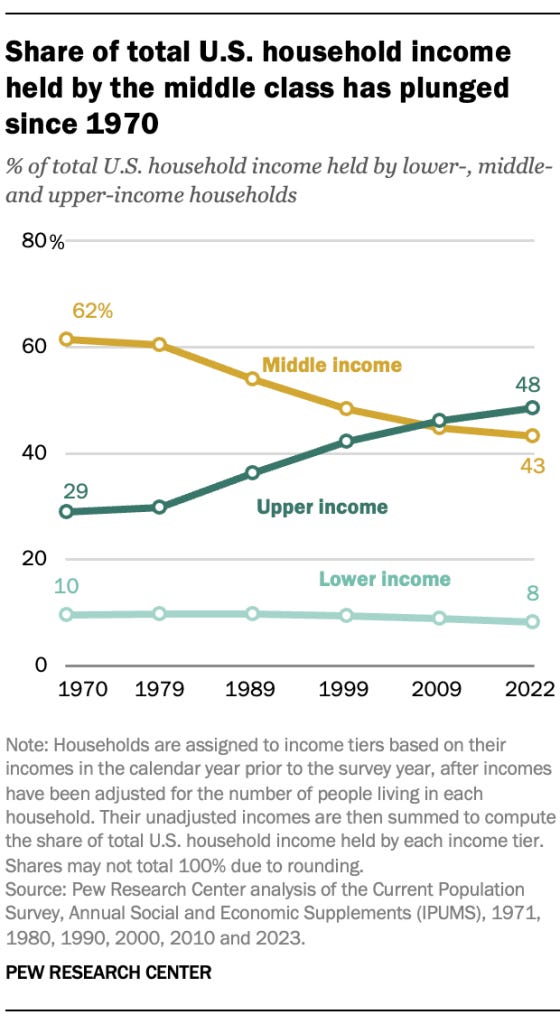

At the same time, according to the Pew Research Center, the share of US income held by the middle and lower class began to decline rapidly3.

So what happened in 1970? Both of these trends initially started during the Carter administration’s stagflation4 crisis. But they were accelerated by Regan’s ‘remedy’ of supply side economics which promised that tax cuts on high income individuals would re-invigorate the economy, and ‘trickle down’ to everyone. They did not5.

In spite of this failure and 30 years of objective proof that it has never worked, conservative politicians continue to insist that taxes on the rich and government spending are the root of all economic woes.

But the ultimate result of post Regan economic policies can be seen in changes in wealth. The chart below tracks total wealth held by percentile. The black line, which is almost unchanged since 2001, represents the net worth of the least wealthy 50% of all households. The other lines track the 50th to 90th percentile (green), the 90th to 99th percentile (red), and the top 1% (blue).

It’s clear that the gains from the US economy have not been distributed equally, with the vast majority of wealth accruing to the very richest individuals. And for most politicians, economists, and talking heads the economy is doing great. But this trend is not sustainable. An economy needs consumers to buy the products that it’s producing, and they are increasingly unable to do so.

Where does this wealth come from? Lower income people spend most of their income on consumption (food, housing, etc.). But when they spend their money it is accumulated by the wealthy who own the assets. Food purchases go to owners of farmland and food production companies. Mortgage payments go to lenders. Rents go to owners of houses and apartments. And profits from thousands of public companies go to stockholders. The cycle is predictable and inevitable6. Money continually flows from consumers to asset owners. And the only way for the government to get this money and wealth back is via taxation.

So what does the future look like? If the concentration of wealth continues it is inevitable that our economy will continue to decline and ultimately collapse.

How Do We Fix It?

I recognized this problem instinctively quite some time ago, but didn’t have the understanding or knowledge to explain it or propose a solution. But I recently came across Gary Stevenson, an economist and former Citibank trader who made millions predicting and betting on how wealth inequality will lead to the decline and ultimate collapse of the world’s economies. The story of his origins as a poor kid growing up in London to the most successful Citibank trader in the world is fascinating and a great read7.

But Gary’s success led him to question the morality of the system that created it and he quit to pursue a mission to educate the world on the economic death spiral that inequality creates and try to stop it. The result is a YouTube channel titled “Gary’s Economics” which currently has over a million subscribers and is growing rapidly. His videos include an extensive course on economics that is easy to follow.

The short clip below is from a 45 minute video titled “This is How We Stop It” which is a summary of the wealth inequality problem and a roadmap for action; “Tax Wealth, Not Work”.

I believe that Gary’s diagnosis and prescription are accurate and timely. My goal is to help share this message.

Questions:

Do you believe that the economy is good or bad?

Is wealth inequality a problem?

Is it possible to tax wealth?